Portfolio Update #1

Portfolio as at 19 March 2025

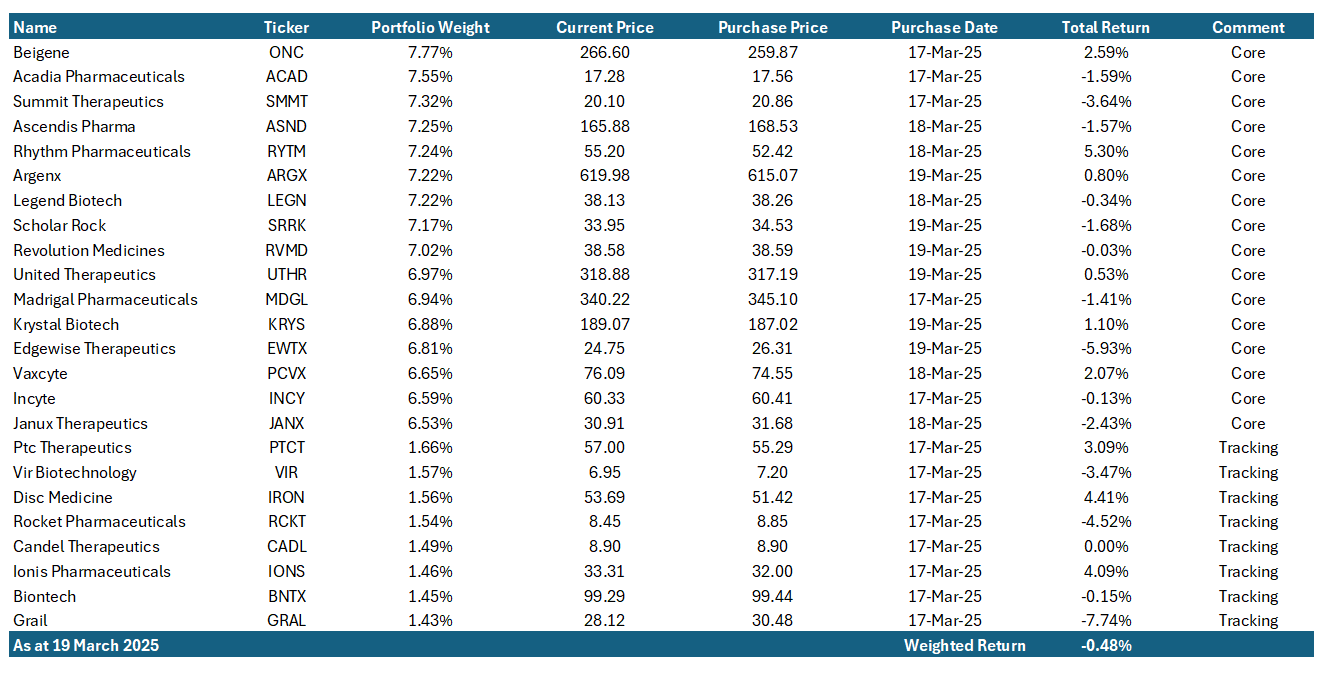

After several months of research I have established a portfolio of 16 equal-weight “core” positions and 8 equal-weight “tracking” positions totalling 24 positions. To be honest, this feels like too many to follow closely. I would like to get this down to between 15-18 positions over time. I will look to unwind some tracking positions and reallocate to others in due course.

For the initial portfolio update, please see below:

In terms of what I am looking for in a potential investment, I have the following broad criteria:

US listed;

Companies with a platform that can enable further drug development over time;

Late stage clinical trials - Phase 3 preferably and a pipeline of other drugs in various stages of clinical trials;

A development pipeline across different disease profiles; and

Ideally some medicines in market to demonstrate the ability to commercialize as well as fund (at least partially) the companies ongoing R&D pipeline.

As such, many of these investment are pre-revenue and subject to significant technical, clinical, and market risk. I consider it prudent to have at least 15 names to mitigate concentration risk in the portfolio.

All positions are intended to be long-term investments. Obviously, I will close positions if/when circumstances change and provide an update.

I will post a portfolio update at month-end each month to show holdings, changes to the portfolio (if any) and returns for the portfolio to date.

I welcome any comments, questions or feedback in respect of the portfolio.

Do your own due diligence. This is general in natural and does not constitute personal financial or investment advice. Biotech and Life Sciences investment is highly speculative by nature and there is risk of significant (or total) loss of capital.

Why no AKESF?